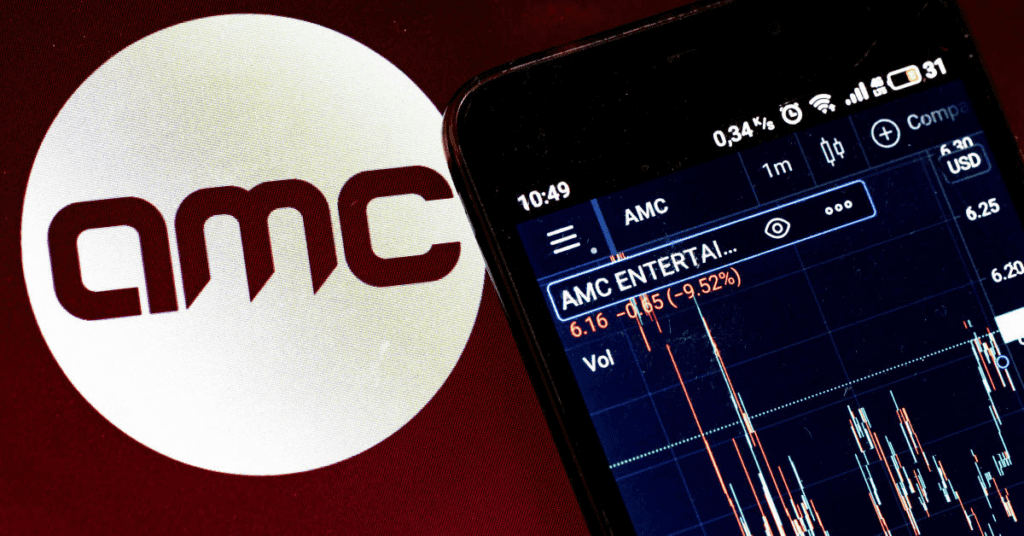

AMC Entertainment Holdings Inc. (AMC) has been one of the most talked-about stocks in recent years, fueled by the meme stock phenomenon, retail investor influence, and market volatility. As a major player in the entertainment industry, AMC has navigated economic disruptions, streaming competition, and significant financial challenges, making it a focal point for investors and traders alike.

This FintechZoom AMC Stock Analysis provides a comprehensive breakdown of AMC’s stock performance, real-time data insights, technical analysis, and trading strategies. Whether you’re an investor looking for price targets or someone interested in how market sentiment affects stock price movements, this deep dive will equip you with valuable insights.

Quick Facts: AMC Stock

| Category | Details |

| Company Name | AMC Entertainment Holdings Inc. |

| Stock Ticker | AMC |

| Industry | Entertainment (Movie Theaters) |

| Founded | 1920 |

| Headquarters | Leawood, Kansas, USA |

| Number of Theaters | 900+ worldwide |

| Total Debt | $5.1 billion |

| Annual Revenue (2024) | $4.5 billion |

| Operating Cash Flow | -$200 million |

| Major Competitors | Netflix, Disney+, Regal Cinemas |

| Retail Investor Ownership | 70%+ |

| Institutional Ownership | ~25% |

| Short Interest | High (Frequently Targeted) |

| Peak Meme Stock Price (2021) | $72+ per share |

| Current Market Sentiment | Volatile & Highly Speculative |

Introduction

AMC Entertainment Holdings Inc. has experienced extreme stock price movements, making it one of the most unpredictable stocks in recent history. The rise of retail investors, particularly from platforms like Reddit WallStreetBets, has dramatically affected its valuation, driving both short squeezes and rapid sell-offs.

In this article, we’ll explore AMC financial health, the impact of streaming competition, and how FintechZoom and FastBull provide powerful insights for investors seeking real-time stock analysis and informed trading decisions.

Overview of AMC Entertainment Holdings

AMC Entertainment Holdings operates one of the world’s largest theater chains, with over 900 locations worldwide. Founded in 1920, AMC has long been a leader in the movie theater industry, but it faced severe challenges due to:

Debt Challenges: AMC incurred over $5 billion in debt to stay afloat during the financial crisis caused by the pandemic, raising concerns about future sustainability.

COVID-19 Impact: The pandemic caused significant revenue losses due to theater shutdowns and reduced attendance.

Streaming Competition: The rise of streaming services like Netflix, Disney+, and HBO Max has shifted consumer preferences away from movie theaters.

Despite these issues, AMC has capitalized on its meme stock status, raising money from stock sales and restructuring debt. However, the company’s ability to sustain long-term profitability remains uncertain.

| AMC Financial Snapshot (2024) | Amount (in Billions USD) |

| Total Debt | $5.1B |

| Annual Revenue | $4.5B |

| Operating Cash Flow | -$200M |

| Number of Theaters | 900+ |

The Meme Stock Phenomenon & Retail Investor Influence

How AMC Became a Meme Stock

The meme stock movement was driven by retail investors who used social media platforms like Reddit, Twitter, and Discord to organize mass stock purchases. The goal? Disrupt traditional Wall Street trading by triggering short squeezes on highly shorted stocks.

Retail investors drove AMC stock price from $2 to over $72 in 2021.

Hedge funds betting against AMC suffered massive short squeeze losses.

AMC leveraged retail enthusiasm by selling stock to raise capital.

Quote: AMC is not just a stock; it’s a movement. Reddit Investor

However, extreme market volatility and unpredictable stock price swings make AMC a high-risk, high-reward investment.

Key Factors Influencing AMC Stock Price Movements

1. Retail Investor Sentiment & Market Trends

Retail traders have dominated AMC’s stock performance, often overriding traditional financial analysis. When investor sentiment is positive, AMC stock skyrockets; when sentiment shifts, massive sell-offs occur.

Key Retail Investor Trends:

- WallStreetBets & Reddit Hype – AMC remains a top-discussed stock.

- Options Trading – High-volume call options fuel price swings.

- Fear of Missing Out (FOMO) – Sudden spikes encourage rapid buying.

2. Financial Analysis & Debt Management

Despite stock market excitement, AMC financial health remains fragile. High debt levels and negative cash flow are red flags for long-term investors.

Debt Management Strategies:

Issuing new shares to raise capital

Refinancing high-interest debt

Expanding revenue streams beyond theaters

3. Streaming Competition & Industry Shifts

The rise of Netflix, Disney+, and other streaming platforms has changed how people consume entertainment. AMC has responded by:

- Exclusive theatrical releases before movies hit streaming.

- Premium large-format experiences (IMAX & Dolby).

- Partnerships with streaming services for joint promotions.

However, consumer habits continue shifting, making AMC’s long-term revenue model uncertain.

4. Institutional Investors & Hedge Fund Activity

While retail investors drive short-term price movements, institutional investors influence AMC’s long-term valuation.

| Investor Type | % Ownership |

| Retail Investors | 70%+ |

| Institutional Funds | 25% |

| Hedge Funds | 5% |

Major hedge funds frequently short AMC stock, betting on its decline, while retail traders fight back, creating a cycle of extreme volatility.

FintechZoom Comprehensive AMC Stock Analysis

Real-Time Data & Market Insights

FintechZoom provides real-time stock price movements, market updates, and breaking news to help investors stay ahead.

Advanced Technical Analysis Tools

Using FintechZoom technical analysis tools, traders can analyze:

- Support & resistance levels

- Moving averages (50-day, 200-day)

- RSI & MACD indicators for trend identification

FastBull Role in Enhancing AMC Stock Analysis

FastBull provides additional real-time market signals and trading strategies, integrating with FintechZoom to enhance investor decision-making.

FastBull Key Features:

- Real-time alerts on stock price trends

- AI-driven investment insights

- Customized risk management tools

Trading Strategies for AMC Stock Investors

For Long-Term Investors:

Monitor debt reduction & profitability.

Watch for partnerships & expansion strategies.

For Short-Term Traders:

Use FintechZoom & FastBull for technical signals.

Trade during high market volatility periods.

Case Studies: Major AMC Stock Movements

June 2021 Short Squeeze: AMC stock surged over 400% in weeks, forcing hedge funds to cover losses.

2022 Sell-Off: AMC’s stock dropped as retail investor enthusiasm declined and fundamentals took priority.

FAQs

Why is AMC stock so volatile?

AMC stock experiences high volatility due to retail investor influence, meme stock trends, and market speculation, leading to unpredictable price swings.

How does FintechZoom help with AMC stock analysis?

FintechZoom provides real-time data, financial analysis, technical charts, and market insights, helping investors track AMC’s performance effectively.

What impact does streaming competition have on AMC stock?

The rise of platforms like Netflix and Disney challenges AMC’s traditional theater business, affecting revenue and stock performance.

Is AMC a good investment for the long term?

AMC long-term potential depends on debt management, profitability, and adaptation to industry changes like digital streaming and evolving consumer habits.

How can I use technical analysis to trade AMC stock?

Investors can use chart patterns, moving averages, and market signals to identify trends and make informed trading decisions.

Conclusion

AMC Entertainment Holdings Inc. remains one of the most volatile and closely watched stocks in the market, driven by retail investor enthusiasm, meme stock momentum, and industry challenges. While its future depends on factors like debt management, streaming competition, and market sentiment, AMC continues to adapt to evolving market conditions.

FintechZoom real-time data, stock analysis, and financial insights provide investors with the tools needed to navigate AMC’s unpredictable stock price movements. Additionally, FastBull’s strategic trading insights further enhance decision-making. Whether you’re a trader looking for short-term gains or a long-term investor, staying informed is key to managing risks and capitalizing on opportunities.

Hi, I’m Zayn, the Website Admin of HubFinanceWorld. With over five years of experience in content creation, I specialize in crafting engaging and insightful articles that empower readers to make informed financial decisions. My expertise in writing, editing, and website management ensures that HubFinanceWorld delivers high-quality content tailored to your needs.