The housing market has delivered good news to prospective homebuyers and homeowners alike: 30-year mortgage rates have dropped to the cheapest level of 2025. After a turbulent rise to some of the highest levels in recent years, the current mortgage rates have stabilized, offering a golden opportunity for those seeking a home loan or considering refinancing.

In this comprehensive guide, we will dive deep into the factors affecting mortgage rates today, explore current mortgage rate trends, and discuss how to take advantage of this favorable financial environment. Whether you’re a first-time buyer, seasoned investor, or homeowner exploring refinancing, this blog will provide actionable insights tailored to your needs.

What Are 30-Year Mortgage Rates, and Why Are They Important?

Understanding 30-Year Fixed Mortgage Rates

A 30-year fixed mortgage is the most common home loan in the U.S. It offers borrowers the ability to repay their loan in fixed monthly installments over 30 years. The fixed interest rate ensures consistent payments, making it an attractive option for long-term stability.

- Key Features of 30-Year Mortgages:

- Fixed Monthly Payments: Your principal and interest remain constant throughout the loan term.

- Affordability: Lower monthly payments compared to shorter-term loans like 15-year fixed mortgages.

- Long-Term Flexibility: Ideal for buyers planning to stay in their homes long-term or who prioritize cash flow management.

Why Mortgage Interest Rates Matter

Mortgage interest rates directly impact the affordability of your home loan. A slight change in rates can significantly affect your monthly mortgage payment and the total cost of your loan over 30 years. For example:

| Loan Amount | Interest Rate | Monthly Payment | Total Interest Paid | Total Mortgage Cost |

| $300,000 | 6.94% | $1,991.60 | $417,976.38 | $717,976.38 |

| $300,000 | 7.50% | $2,096.40 | $453,704.27 | $753,704.27 |

The table above illustrates how even a 0.56% difference in rates can add tens of thousands of dollars to your mortgage cost.

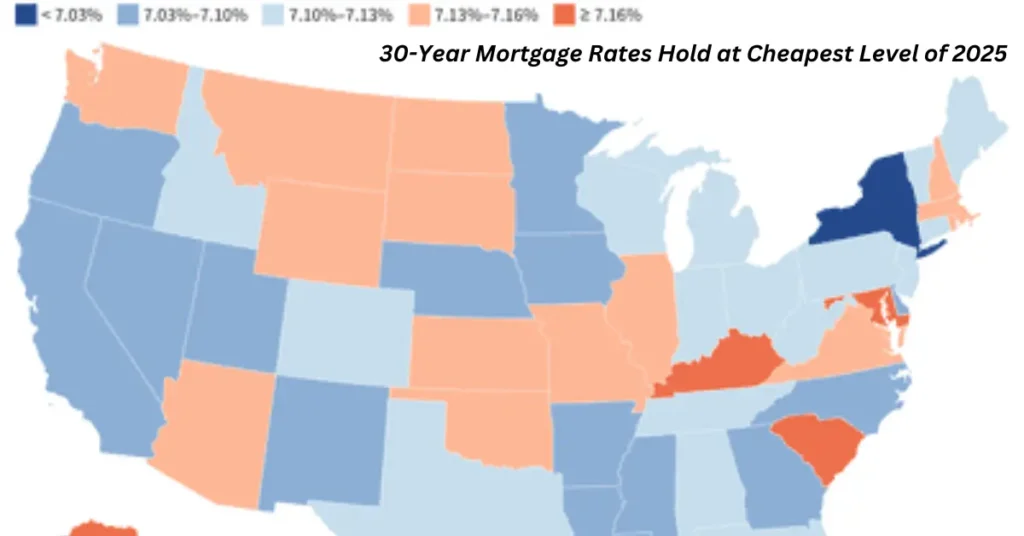

Current Trends in 30-Year Mortgage Rates

Mortgage Rates Today: 6.94% Average

The national average of mortgage rates for 30-year fixed mortgages stands at 6.94%, the cheapest level of 2025. This is a welcome relief following last year’s peak of 8.01% in October 2023, the highest in over two decades.

National Averages of Mortgage Rates by Loan Type

The Zillow Mortgage API provides current averages across various loan types:

| Loan Type | New Purchase Rates | Daily Change |

| 30-Year Fixed Mortgage | 6.94% | No Change |

| FHA 30-Year Fixed | 7.50% | +0.15 |

| VA 30-Year Fixed | 6.46% | +0.03 |

| 15-Year Fixed Mortgage | 6.07% | +0.01 |

| Jumbo 30-Year Mortgage | 6.83% | No Change |

Borrowers should note that loan type rates vary depending on factors like credit score, down payment, and loan amount.

Why Are Mortgage Rates Falling in 2025?

Several economic factors have contributed to this downward trend:

- Federal Reserve Policy

The Federal Reserve has played a significant role in shaping the mortgage market. After aggressively raising rates to combat inflation in 2022 and 2023, the Fed implemented rate cuts starting in late 2024. These cuts, combined with cautious optimism about the economy, have influenced the bond market and lowered 10-year Treasury yields, a key indicator for mortgage rates. - Bond Market Trends

Mortgage rates closely follow the movement of 10-year Treasury yields. As yields decline, lenders adjust their rates downward, resulting in lower current mortgage rates for borrowers. - Improved Housing Market Dynamics

Increased competition among lenders and a stabilization in housing demand have created an environment conducive to lower home loan rates.

What This Means for Homebuyers and Homeowners

For Homebuyers

If you’re considering purchasing a home, 30-year fixed mortgage rates at 6.94% represent an opportunity to secure favorable financing. Here’s how it benefits you:

- Lower Monthly Payments:

A $440,000 home with a 20% down payment and a 6.94% interest rate results in a monthly payment of $1,949.63. - Increased Affordability:

Lower rates mean you can afford a more expensive home or reduce your monthly financial burden.

For Homeowners

Refinancing at current mortgage rates can save you thousands over the life of your loan. If you’re paying a rate above 7%, this is the perfect time to compare refinance options.

Expert Tips for Securing the Best Mortgage Rate

- Compare Mortgage Rates Regularly

Use tools like the Zillow Mortgage API or consult multiple lenders to find the best deal. - Improve Your Credit Score

A higher credit score can qualify you for lower mortgage interest rates. Aim for a score above 740 to secure the best offers. - Consider Loan Types Carefully

While 30-year fixed mortgages are popular, alternatives like 15-year fixed mortgages or FHA loans may suit your financial goals better. - Lock in Your Rate

Mortgage rates can change daily. Lock in your rate once you’ve found a favorable offer to avoid future increases.

Calculate Your Monthly Payment

Understanding your mortgage payment is critical. Here’s a case study using a mortgage calculator:

- Home Price: $440,000

- Down Payment: $88,000 (20%)

- Loan Term: 30 years

- Interest Rate: 6.94%

| Expense | Amount |

| Principal & Interest | $1,564.96 |

| Property Taxes | $256.67 |

| Homeowners Insurance | $128.00 |

| Total Monthly Payment | $1,949.3 |

What Could Drive Rates Higher or Lower in 2025?

Potential Influences

- Economic Indicators: Changes in inflation and unemployment rates.

- Federal Reserve Actions: Future rate cuts or pauses could impact the bond market.

- Global Events: Uncertainty in global markets can affect Treasury yields.

Frequently Asked Questions

What are 30-year mortgage rates?

30-year mortgage rates refer to the interest rates on loans with a 30-year repayment term, typically for buying or refinancing homes.

Why are 30-year mortgage rates popular?

They offer lower monthly payments compared to shorter-term loans, making home ownership more affordable.

How are current mortgage rates determined?

Rates depend on factors like the bond market, Federal Reserve policies, and borrower credit scores.

What is the Freddie Mac Weekly Average?

It’s a weekly report showing national average mortgage rates based on Freddie Mac’s analysis of lender data.

Are 15-year mortgage rates better than 30-year rates?

15-year rates are lower, but monthly payments are higher due to the shorter term.

How can I calculate my monthly mortgage payments?

Use a mortgage calculator to estimate payments based on your loan amount, term, and interest rate.

Conclusion

With 30-year mortgage rates holding steady at their cheapest level of 2025, this is an opportune moment for both buyers and homeowners to capitalize on favorable market conditions. For prospective buyers, it means the chance to lock in a more affordable mortgage, ensuring long-term stability in monthly payments.

For homeowners, refinancing at these historically low rates offers a pathway to significant savings over the life of the loan. By staying informed about current mortgage rates, leveraging tools like the Zillow Mortgage API, and taking proactive steps to compare loan options, you can make the most of this financial opportunity.

Hi, I’m Zayn, the Website Admin of HubFinanceWorld. With over five years of experience in content creation, I specialize in crafting engaging and insightful articles that empower readers to make informed financial decisions. My expertise in writing, editing, and website management ensures that HubFinanceWorld delivers high-quality content tailored to your needs.